Chime Bank-Is it Worth it?

I have been with my traditional bank since 2003. Over the years, I have given the well known bank a large sum of money for overdraft and maintenance fees, and I was recently charged a $5 fee to replace my lost debit card. I can kick myself for how much money I have given the traditional bank system just for fees.

Last year while I was reading a post from The Penny hoarder, I discovered Chime. I was sold when I read that they do not charge fees. That's right, no fees! No overdraft fees, no maintenance fees, no foreign transaction fees. I am not planning a trip abroad anytime soon, however this is good information to know when I plan to travel in the future.

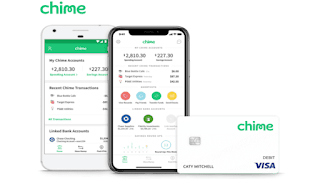

I downloaded the app and signed up for a checking and savings account. I received my debit card in a green envelope within five days.

Pros

One of the biggest pros of using Chime is that you can receive your paycheck up to two days early. When I was working part time at Bath & Body Works last year, I decided to give this feature a test drive. The company pays their employees on Friday, However the money was deposited into my account on Thursday.

If you are struggling to save money, you can automate your savings. Chime gives you two ways to save. When you turn on automatic roundups, the app will round up each purchase to the nearest dollar and deposit it into your savings account. Also you when you get paid, you can automatically deposit 10% of your earnings into your savings account.

One of my favorite features of Chime is that you will receive a notification every time you make a purchase and will update you on how much is available in your account. This feature may be annoying to some, however this is good for those who are striving to stick to a budget.

Recently when I lost my wallet, I had to order a new debit card. I was able to request a new card without paying for a replacement card. However on the other hand my traditional bank charged me a fee to receive a new card.

Cons

One of the biggest cons to Chime is depositing cash. In order to deposit cash, you will need to go to retailer such as Walgreens or CVS, or another retailer that offers Green Dot. You can search for nearby retailers within the app. I decided to test this feature out to see how it works. I was able to deposit cash at my neighborhood Dollar General. The app says that it may take several hours for the money to appear in your account. However, when I deposited the money, it was in my checking account immediately.

My Final Thoughts

Overall, I am satisfied with Chime and will continue to use their services. If you choose to use an online bank or a traditional bank, keep in mind that each system has its pros and cons. I would encourage anyone to weigh their options. Another downside to Chime is that everything is done through the mobile app. I personally find the mobile app to be user friendly. On one hand this is convenient for those who have busy schedules and aren't able to go to a physical bank.This may not be a good fit for someone who isn't tech savy or prefers human interaction.

If you need further motivation to sign up, Chime offers $50 per referral. When you refer friends and family, each person will get $50 and you will get $50. You can sign up for Chime by using my referral link.

Comments

Post a Comment