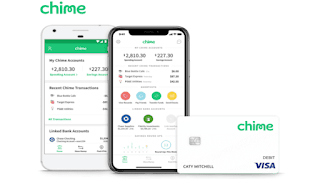

Chime Bank-Is it Worth it?

I have been with my traditional bank since 2003. Over the years, I have given the well known bank a large sum of money for overdraft and maintenance fees, and I was recently charged a $5 fee to replace my lost debit card. I can kick myself for how much money I have given the traditional bank system just for fees. Last year while I was reading a post from The Penny hoarder, I discovered Chime. I was sold when I read that they do not charge fees. That's right, no fees! No overdraft fees, no maintenance fees, no foreign transaction fees. I am not planning a trip abroad anytime soon, however this is good information to know when I plan to travel in the future. I downloaded the app and signed up for a checking and savings account. I received my debit card in a green envelope within five days. Pros One of the biggest pros of using Chime is that you can receive your paycheck up to two days early. When I was working part time at Ba...